Overview

As the fintech landscape continues to evolve, artificial intelligence (AI) is becoming an indispensable tool for businesses seeking to enhance efficiency, security, and customer experience. For fintech companies, particularly payment gateways, building AI capabilities is not just a strategic advantage but a necessity. However, successful AI integration requires significant investment in both talent and infrastructure. This article explores how fintech companies can strategically invest in these areas to unlock the full potential of AI, supported by detailed technical insights and data-driven examples.

1. The Importance of AI in Fintech

AI is revolutionizing the fintech sector by enabling more sophisticated fraud detection, personalized customer experiences, and operational efficiencies. For example, AI-powered payment gateways can analyze vast amounts of transaction data in real-time to detect fraudulent activities, improving security and reducing losses. According to a report by Juniper Research, AI is expected to save the banking industry over $1 trillion by 2030, primarily through enhanced fraud detection, process automation, and customer support improvements.

2. Investing in Talent: Building the Right Team

Building a successful AI strategy starts with having the right team in place. This team needs to be diverse, bringing together expertise in data science, machine learning, AI ethics, and domain-specific knowledge of the fintech industry.

Key Roles and Responsibilities:

- Data Scientists: Data scientists are the backbone of any AI initiative. They are responsible for collecting, analyzing, and interpreting data to build predictive models. In a payment gateway, data scientists might develop algorithms that analyze transaction patterns to detect anomalies indicative of fraud.

- Machine Learning Engineers: While data scientists design models, machine learning engineers focus on implementing them. They optimize algorithms for real-time processing and integrate them into the payment gateway’s infrastructure. For example, an engineer might deploy a deep learning model that processes thousands of transactions per second to identify fraudulent activity.

- AI Ethicists: As AI becomes more integrated into financial systems, ensuring ethical AI use is critical. AI ethicists help to design systems that are transparent, fair, and compliant with regulations, addressing issues such as algorithmic bias and data privacy.

- Domain Experts: Professionals with deep knowledge of the fintech industry, particularly in payment processing, provide valuable insights that help tailor AI solutions to meet specific business needs.

Challenges in Hiring AI Talent: The demand for AI talent is skyrocketing, with LinkedIn’s 2023 Emerging Jobs Report highlighting AI specialists as one of the fastest-growing job categories globally. However, finding skilled professionals remains a challenge. According to a survey by Gartner, 54% of CIOs identified talent shortages as the biggest barrier to AI adoption.

Strategies to Build AI Talent:

- Upskilling and Reskilling: Invest in upskilling your current workforce. Offer training programs and workshops to help existing employees gain expertise in AI and machine learning. Online platforms like Coursera, edX, and Udacity provide courses tailored to AI and data science, which can be invaluable in building your team’s capabilities.

- Collaborations with Academia: Partner with universities and research institutions to access emerging AI talent. These collaborations can include internships, joint research projects, and recruitment drives aimed at recent graduates.

- AI Talent Networks: Engage with AI talent networks and professional organizations. These communities often host events, conferences, and workshops that can be excellent opportunities for recruiting AI professionals.

3. Investing in Infrastructure: Building the Technical Foundation

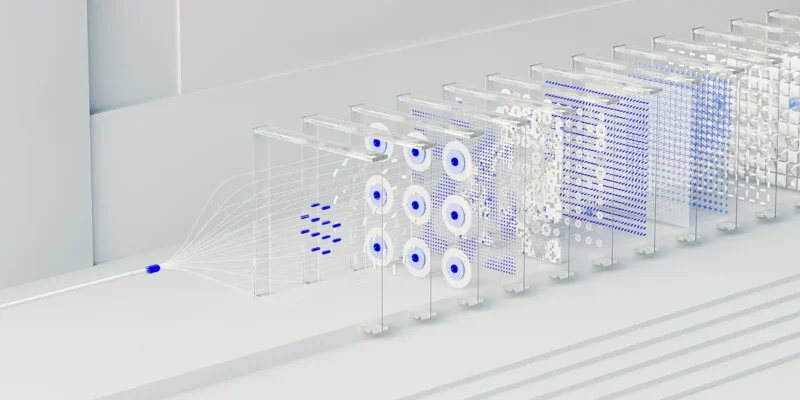

AI applications, especially in fintech, require a robust technical infrastructure capable of handling vast amounts of data and performing complex computations in real-time.

Key Components of AI Infrastructure:

- Data Infrastructure: Data is the fuel that powers AI. For payment gateways, this includes transaction data, customer information, and historical fraud patterns. Ensuring that your data infrastructure is capable of storing, processing, and securing this data is critical.

- Data Lakes and Warehouses: Implement data lakes or warehouses to centralize your data. Tools like Amazon Redshift, Google BigQuery, and Snowflake are popular choices for scalable data storage and processing.

- Data Pipelines: Develop data pipelines that automate the flow of data from collection to processing and storage. Apache Kafka and Apache NiFi are widely used for building real-time data pipelines, ensuring that AI models have access to up-to-date information.

- Computing Power: AI, particularly machine learning and deep learning, requires significant computational resources. For example, training a deep learning model to detect fraud in real-time requires high-performance computing (HPC) capabilities.

- GPUs and TPUs: Invest in specialized hardware like GPUs (Graphics Processing Units) and TPUs (Tensor Processing Units), which are optimized for AI workloads. NVIDIA’s GPUs and Google’s TPUs are industry standards for training and deploying AI models at scale.

- Cloud Computing: Consider leveraging cloud computing platforms like AWS, Google Cloud, or Microsoft Azure, which offer scalable AI services and infrastructure. These platforms provide on-demand access to powerful computing resources, making it easier to scale AI initiatives without significant upfront investments in hardware.

- APIs and Integration: Ensure that your AI systems can integrate seamlessly with your existing fintech infrastructure. Payment gateways often use APIs to connect with banks, merchants, and other financial institutions. These APIs must be designed to handle AI-driven features like fraud detection and personalized recommendations.

- Microservices Architecture: Adopt a microservices architecture that allows different components of your system to operate independently and communicate via APIs. This approach enables greater flexibility and scalability, allowing you to deploy and update AI models without disrupting the entire system.

Technical Implementation Example — Fraud Detection in Payment Gateways:

- Real-time Fraud Detection: A payment gateway can implement a real-time fraud detection system using machine learning models. First, historical transaction data is fed into a machine learning model (e.g., a deep neural network) to identify patterns associated with fraudulent transactions. This model is then deployed in the gateway’s transaction processing system, where it analyzes each transaction in real-time.

- High-Performance Computing: To ensure the model processes transactions within milliseconds, the gateway might use GPUs or TPUs to accelerate computation. If a transaction is flagged as suspicious, the system can automatically trigger additional verification steps, reducing the risk of fraud.

4. Ensuring Scalability and Flexibility

As your AI initiatives grow, it’s essential to ensure that your infrastructure and talent pool can scale to meet increasing demands. Scalability is particularly important in fintech, where transaction volumes can fluctuate significantly.

Scalability Strategies:

- Cloud-based AI Solutions: Cloud platforms offer elastic computing resources, meaning you can scale up or down based on demand. This is particularly useful for handling peak transaction periods without over-investing in on-premise hardware.

- Automated Scaling: Implement automated scaling solutions that adjust computing resources in real-time based on workload. For example, if transaction volumes increase during a holiday season, your fraud detection model can automatically access more computing power to maintain performance.

- Continuous Integration and Continuous Deployment (CI/CD): Adopt CI/CD practices to ensure that AI models and infrastructure updates are deployed seamlessly. This approach allows your development team to push updates to AI models regularly, ensuring they remain accurate and effective as new data becomes available.

Technical Implementation Example — Scalable AI for Payment Gateways:

Auto-scaling AI Models: Implement auto-scaling for AI models deployed on cloud platforms. For instance, an AI-powered customer support bot integrated into your payment gateway can automatically scale its computing resources based on the number of user queries, ensuring that customer support remains responsive during high-traffic periods.

5. Maintaining AI Systems: Monitoring and Optimization

Building AI capabilities is an ongoing process that doesn’t end with implementation. Continuous monitoring and optimization are necessary to ensure that your AI systems remain effective and deliver the desired outcomes.

Monitoring and Optimization Strategies:

- Performance Metrics: Regularly monitor the performance of your AI models using metrics like accuracy, precision, recall, and F1-score. For payment gateways, tracking the false positive rate (flagging legitimate transactions as fraud) and false negative rate (missing actual fraudulent transactions) is crucial.

- Feedback Loops: Implement feedback loops where the outcomes of AI decisions are reviewed and fed back into the model for retraining. This approach ensures that your AI models learn from their mistakes and improve over time.

- Model Retraining: Periodically retrain your AI models using new data to account for changing patterns in user behavior or fraud tactics. Automated model retraining pipelines can streamline this process, reducing the need for manual intervention.

Technical Implementation Example — AI Optimization in Payment Gateways:

Adaptive Fraud Detection: Implement an adaptive fraud detection system that continuously learns from new transaction data. As fraud tactics evolve, the system can retrain itself using the latest data, ensuring that it remains effective in identifying new forms of fraud.

6. The Role of AI in Future-proofing Fintech Businesses

Investing in AI talent and infrastructure is not just about addressing current challenges — it’s about future-proofing your fintech business. As AI technologies continue to advance, the companies that have built strong AI capabilities will be better positioned to innovate and stay ahead of the competition.

Future Trends in AI for Fintech:

- AI-driven Personalization: As AI becomes more sophisticated, payment gateways will be able to offer highly personalized experiences, from tailored payment options to individualized security measures.

- Predictive Analytics: AI will enable fintech companies to predict user behavior with greater accuracy, allowing for proactive measures to prevent fraud, optimize user experiences, and drive growth.

- Integration with Emerging Technologies: AI will increasingly integrate with other emerging technologies like blockchain, enhancing security and transparency in financial transactions.

Conclusion: Building AI Capabilities for Long-term Success

For fintech companiesFor fintech companies, particularly payment gateways, building AI capabilities is critical to achieving long-term success in an increasingly competitive market. As AI technologies continue to evolve, investing in the right talent and infrastructure will enable your business to harness AI’s full potential, driving innovation, efficiency, and security.

Investing in AI Talent: Building a Team for the Future

Building a strong AI team is the first step toward effective AI implementation. The demand for AI talent has surged, with data scientists, machine learning engineers, and AI ethicists being among the most sought-after roles in the tech industry. According to a 2023 report by Gartner, the shortage of AI talent is a significant barrier to AI adoption for 54% of CIOs. To overcome this challenge, fintech companies need to adopt a strategic approach to hiring and talent development.

Key Roles in AI Implementation:

- Data Scientists: Data scientists analyze vast datasets to build predictive models that can, for example, identify fraudulent transactions in real-time.

- Machine Learning Engineers: These engineers develop and optimize AI algorithms, ensuring they are scalable and integrate seamlessly with existing systems.

- AI Ethicists: As AI systems make decisions that impact users, ethical considerations become crucial. AI ethicists ensure that AI implementations are fair, transparent, and compliant with regulations.

Strategies for Building an AI Team:

- Upskilling Existing Employees: Offering training programs for your current workforce can bridge the skills gap. Online platforms like Coursera, Udacity, and DataCamp offer specialized courses in AI and machine learning that can help employees develop the necessary skills.

- Hiring External Talent: Actively recruiting AI specialists from outside the organization is essential. This may involve working with recruitment agencies or partnering with academic institutions to tap into emerging talent pools.

- Collaborations with Universities: Partnering with universities for research and development can help fintech companies stay at the forefront of AI innovation. These collaborations can also provide a pipeline of trained graduates ready to join the workforce.

Case Study — PayPal: PayPal has invested heavily in building its AI capabilities. By recruiting top AI talent and establishing partnerships with research institutions, PayPal has developed sophisticated AI models that analyze over 100 different variables in real-time to assess the risk of each transaction. This approach has helped PayPal maintain a fraud loss rate of less than 0.32%, significantly lower than the industry average.

Investing in Infrastructure: Building a Technical Foundation for AI

AI applications, especially those used in fintech, require robust infrastructure to support data storage, processing, and real-time analysis. The success of AI initiatives depends on having the right technical foundation in place.

Key Components of AI Infrastructure:

- Data Infrastructure: AI models rely on vast amounts of high-quality data. For payment gateways, this includes transaction data, customer profiles, and fraud patterns. Implementing data lakes or warehouses allows companies to centralize data storage and ensure that it is readily accessible for AI processing. Tools like Amazon Redshift, Google BigQuery, and Snowflake are popular for scalable data storage and processing.

- Computing Power: AI, particularly machine learning, requires significant computational resources. Investing in GPUs (Graphics Processing Units) and TPUs (Tensor Processing Units) is essential for training and deploying AI models at scale. These specialized processors accelerate the performance of AI algorithms, enabling real-time analysis of transaction data.

- Cloud Computing: Cloud platforms such as AWS, Google Cloud, and Microsoft Azure offer scalable AI services and infrastructure. These platforms provide on-demand access to computing power, allowing fintech companies to scale their AI initiatives without the need for significant upfront investment in hardware.

Technical Implementation Example — Real-Time Fraud Detection: A payment gateway can implement a real-time fraud detection system using machine learning models. Historical transaction data is used to train a deep learning model, which is then deployed within the gateway’s infrastructure. GPUs or TPUs are used to accelerate the processing of transactions, ensuring that fraudulent activities are detected in real-time. If a transaction is flagged as suspicious, the system can automatically trigger additional verification steps, reducing the risk of fraud.

Ensuring Scalability and Flexibility

As fintech companies grow, their AI systems must be able to scale to handle increased transaction volumes. Ensuring scalability and flexibility in your AI infrastructure is crucial for maintaining performance and reliability.

Scalability Strategies:

- Cloud-based AI Solutions: Cloud platforms provide elastic computing resources, allowing companies to scale up or down based on demand. This is particularly useful for handling peak transaction periods without over-investing in on-premise hardware.

- Automated Scaling: Implement automated scaling solutions that adjust computing resources in real-time based on workload. For example, if transaction volumes increase during a holiday season, your fraud detection model can automatically access more computing power to maintain performance.

- Continuous Integration and Continuous Deployment (CI/CD): Adopting CI/CD practices ensures that AI models and infrastructure updates are deployed seamlessly. This approach allows your development team to push updates to AI models regularly, ensuring they remain accurate and effective as new data becomes available.

Technical Implementation Example — Scalable AI for Payment Gateways: A payment gateway can implement auto-scaling for AI models deployed on cloud platforms. For instance, an AI-powered customer support bot integrated into the gateway can automatically scale its computing resources based on the number of user queries, ensuring that customer support remains responsive during high-traffic periods.

Maintaining AI Systems: Monitoring and Optimization

Once AI systems are in place, continuous monitoring and optimization are necessary to ensure they remain effective and deliver the desired outcomes.

Monitoring and Optimization Strategies:

- Performance Metrics: Regularly monitor the performance of AI models using metrics like accuracy, precision, recall, and F1-score. For payment gateways, tracking the false positive rate (flagging legitimate transactions as fraud) and false negative rate (missing actual fraudulent transactions) is crucial.

- Feedback Loops: Implement feedback loops where the outcomes of AI decisions are reviewed and fed back into the model for retraining. This approach ensures that AI models learn from their mistakes and improve over time.

- Model Retraining: Periodically retrain AI models using new data to account for changing patterns in user behavior or fraud tactics. Automated model retraining pipelines can streamline this process, reducing the need for manual intervention.

Technical Implementation Example — Adaptive Fraud Detection: An adaptive fraud detection system continuously learns from new transaction data. As fraud tactics evolve, the system retrains itself using the latest data, ensuring that it remains effective in identifying new forms of fraud.

Conclusion: Investing in AI Talent and Infrastructure for Long-term Success

Building AI capabilities is essential for fintech companies, particularly payment gateways, to remain competitive in an increasingly digital world. The integration of AI can significantly enhance the efficiency, security, and customer experience of your services. However, realizing these benefits requires strategic investment in both talent and infrastructure.

By assembling a multidisciplinary team of data scientists, machine learning engineers, AI ethicists, and domain experts, fintech companies can develop and deploy AI solutions tailored to their specific needs. Simultaneously, investing in the right technical infrastructure — ranging from robust data management systems to scalable computing power — ensures that AI models can operate effectively and efficiently.

Furthermore, as the fintech industry continues to evolve, the ability to scale AI solutions and continuously optimize them will be critical. Cloud-based AI platforms, automated scaling, and continuous integration practices will enable businesses to adapt to changing demands and maintain a competitive edge.

Ultimately, the successful implementation of AI in fintech is not just about adopting new technology — it’s about building a foundation that supports long-term growth and innovation. Companies that strategically invest in AI talent and infrastructure today will be well-positioned to lead the future of the fintech industry, delivering cutting-edge solutions that meet the needs of an increasingly tech-savvy consumer base.

By embracing AI and making the necessary investments, fintech companies can transform their operations, enhance security, and provide more personalized and efficient services to their customers. The future of fintech is AI-driven, and those who act now will be the ones who shape it.